UNLESS you are selling snacks laced with salted eggs, the business of doing retail in Singapore is tough.

With a tiny domestic market, there are no “economies of scale” for retailers to leverage on.

Marketers, analysts and economists often equate the 5.7 million population as the size of the consumer market. Or they might point to the high median household income of about S$9,300 per month and dream that consumers have strong spending power.

The Real Data Is Not So Rosy

1 million of the 5.7 million population are foreign domestic workers and work permit holders (such as those in the construction and waste management industries).

A sizable proportion of the half million permanent residents do not live in Singapore even if they do make regular trips here.

And while we have 1.32 million resident households, 160,000 households have no income or are retired.

The seemingly high median household income of S$9,300 per month is derived from 1.16 million households, skewed upwards by the many wealthy new citizens and new permanent residents.

The real addressable consumer market in Singapore is probably about 4 million individuals. Depending on the products and the location of the shops, some retailers may also consider their target market to include the transient 19 million foreign visitors, who stay 3 to 4 nights in Singapore, and the unknown millions of visitor-trips by Malaysians who cross the causeways.

After this…Brands that have left Singapore…

Walking Away

The recent decision by cosmetic retailer Sasa to withdraw from Singapore is just one of many pieces of evidence about the weak consumer demand. The 22 Sasa stores will be closed and about 170 employees will be affected. Sasa revealed that it suffered six consecutive years of losses despite efforts to turn its fortunes around.

Home-Fix, another household brand that many Singaporeans are familiar with, started 2019 with 11 stores but had closed all their stores by mid-December, marking a complete end to its bricks-and-mortar presence in Singapore.

The failing retail scene is not entirely the fault of the retailers failing to adapt to shifting consumer trends. Home-Fix was heralded by Prime Minister Lee Hsien Loong during the 2018 May Day Rally as a prime example of how retailers were responding to changing consumer preferences and technological disruptions by moving into services, providing experiences and doing online sales.

Nine months after Jewel Changi Airport opened, and claimed visitor numbers higher than the annual visitors to the Vatican Museum and Sentosa Island combined, retailers are already feeling the pain of sub-par sales.

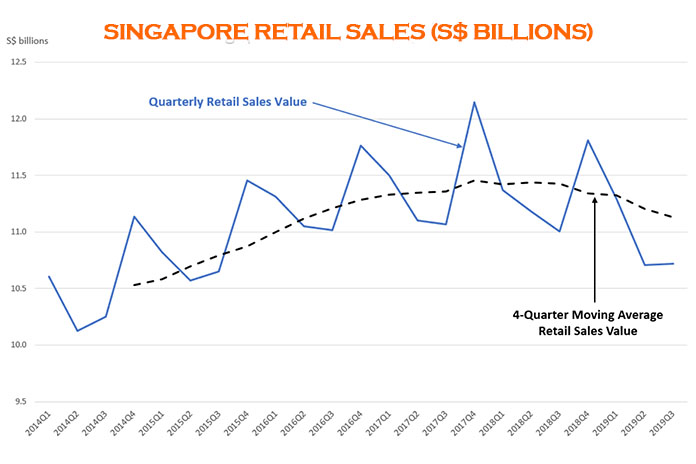

Still, there seems to be no escaping the ills of consumers tightening their belts. Total retail sales value has been dropping since mid-2018 even as population growth is still positive.

Tourist Troubles

But what about the other part of the demand equation? Singapore has often touted tourist dollars as a significant source of income. Visitor arrivals have been growing significantly in the last 3 years — from 16.4 million in 2016 to 17.4 million in 2017 and 18.5 million in 2018. There is a possibility that visitor arrivals will exceed 19 million in 2019.

Sadly, despite higher headcount figures, tourism receipts in shopping and F&B are not growing. According to the Singapore Tourism Board, visitors spent $5.96 billion on shopping in 2016. This increased to $6.17 billion in 2017 and then dropped 13% to $5.39 billion in 2018.

After this…The pills for retail…

F&B receipts declined from $2.79 billion in 2016 to $2.65 billion in 2017 and $2.59 billion in 2018.

We believe that both numbers will drop further when data for 2019 is fully released.

It is worrisome that the record-breaking visitor arrivals in 2018 and 2019 could not prevent retail sales from declining.

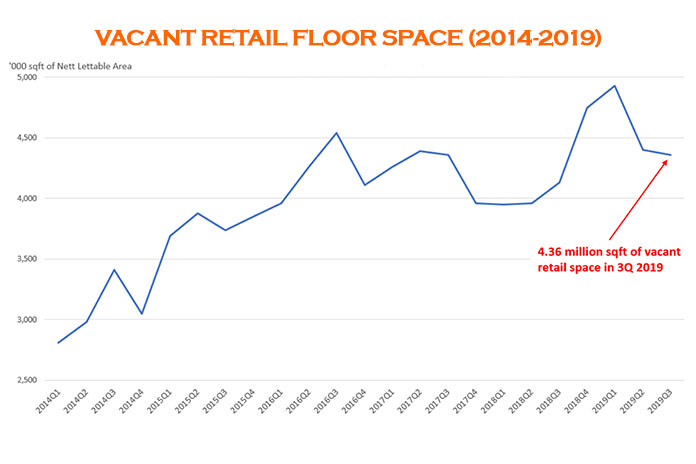

Some signs of retail weakness were apparent long before. Due to an onslaught of new supply and stiff competition from e-Commerce, shop rentals in the Central Area have dropped 18%, from a post-Lehman high of about $9.00 per sqft per month in early 2011, to S$7.32 per sqft per month in late 2019.

Vacant retail space increased over the past decade and hit a record high of 4.9 million sqft in 1Q 2019.

What might prevent the retail apocalypse? What do we do with all the space?

First recommendation. We need to shrink the total stock of retail space quickly, say by 20% of what we have today.

It is not difficult to see why vacant space will keep increasing. As sure as video/DVD shops followed the way of the dodo, shops selling digital cameras, bank branches, bookstores, magazines and newsstands, etc., will be closing in significant numbers. We have previously stated that Orchard Road can be saved only if we stopped thinking of it as a retail street. It has lost the edge and it could do better with 20% of its space repositioned/renovated for medical, health and wellness services and 20% for educational services.

Secondly, let’s not kid ourselves and recognise that creating experiential shopping, mining big data, offering omni-channel touchpoints and services or investing in digitalization (whatever that means) are merely short-term patches. Once a competitor, followed by another, starts to up the ante with services, experience and omni-channel offerings, everyone will be competing at the same level again.

Third recommendation. For all the billions that we poured into scientific research, creating intellectual property and filing patents, we should be spending at least a tenth of the billions in fashion, design and brands. Similar to sports, Singapore has the money to buy the talent, then quickly groom our own talent thereafter.

A distinct lack of local designer brands that are able to tango with international luxury brands means there is zero for anyone to buy as fashion items in Singapore. Fashionistas consider visits to Gucci’s flagship store in Milan, Italy and Chanel’s flagship store in Paris, France as making pilgrimages. Visiting the Orchard Road outlets of Gucci or Chanel is far from that.

A homegrown brand will be able to generate more organic growth for Orchard Road rather than importing the latest and greatest of Hermes and Louis Vuitton: let’s face it, how often will the brand give Singapore the privilege of carrying an item that Paris, London, New York or Tokyo has yet to debut?

A massive investment towards building a range of local luxury fashion brands we are proud of is way overdue. And that just might be that last retail shot in the arm Orchard Road truly needs to cure its ills.

Ku Swee Yong is the CEO of International Property Advisor Pte Ltd. He co-wrote and researched this article with Brandan Koh, a future graduate of Singapore Management University, and Hazel Tan, a future graduate of National University of Singapore.