IT IS no longer a surprise to see large clusters of vacant shops in malls all over Singapore.

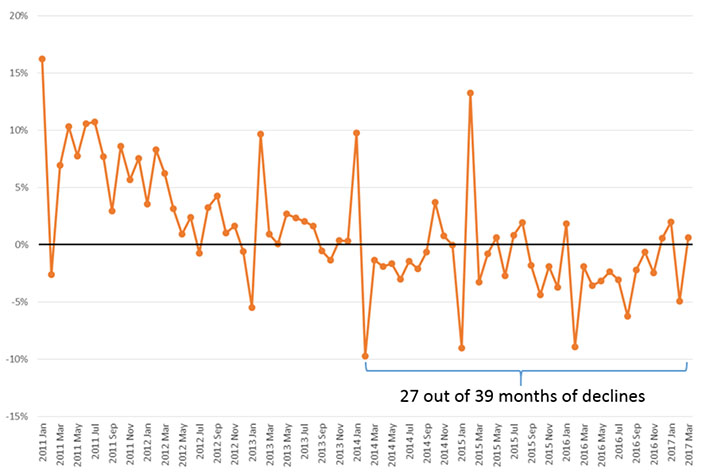

The retail sales index has shown declines in 27 out of the past 39 months since January 2014. Weak retail sales has resulted in retailers racking up losses, with several high profile foreign brands shuttering their doors for good and leaving swathes of retail space vacant.

Retail Sales Index at Current Prices (Excluding Motor Vehicles) Y-o-Y Grouth

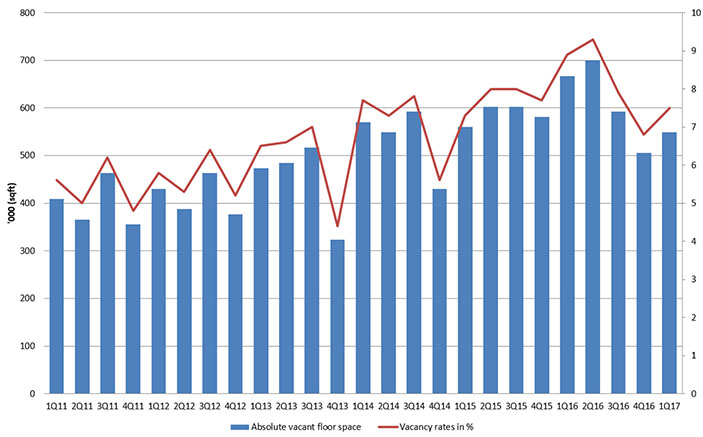

Data from the Urban Redevelopment Authority (URA) reveals that vacant retail space increased islandwide, from about 3.4 million sqft in early 2011 to 5.0 million sqft today.

The situation is similarly grim in Singapore’s preeminent retail belt: Orchard Road.

Vacant retail space hit a high of 700,000 sqft, representing 9.3% of total lettable area, in 2Q 2016. While official data shows that vacant space dropped to 550,000 sqft in 1Q 2017, a walk through several malls reveals that the reduced vacancy is propped up by temporary “pop up” stores.

A shrinking jobs market, flat wage growth and a reduction of high rollers gaming in Singapore have a negative multiplier effect on the consumption levels of the luxury goods and services that are predominantly offered at Orchard Road.

Total vacant floor space and vacancy rtes in Orchard Planning Area

The poor retail performance of Orchard Road sparked calls from a high-level government committee, the Committee on the Future Economy (CFE), to improve the situation. The Committee recommended “that the private sector partner the Government to embark on bold moves to transform Orchard Road into a vibrant shopping and lifestyle destination with a signature street experience in a city garden.”

In addition, many opinion pieces, analyst reports and discussions over forum pages and social media offered suggestions on how Orchard Road might be transformed.

| Top 5 suggestions to transform Orchard Road | |

| 1 | Pedestrianise Orchard Road |

| 2 | Conduct more street level activities with cultural events, performances, shows, festivals, exhibitions |

| 3 | Leverage technology to improve customer-retailer relationships and enhance shopper experience |

| 4 | Provide a wider range of brands, products and services |

| 5 | Increase the number of dining and entertainment options |

The top suggestion put forth involved a fully pedestrianised Orchard Road, such that more fashion, cultural and arts activities, and larger-scale street-level events can be held. Other popular suggestions recognised the need to embrace technology, such as indoor positioning systems, virtual and augmented reality, omni-channel touchpoints, etc. to improve retailer-customer interaction. Others urged retailers to provide a wider range of products, brands, services, dining and entertainment options.

However, no one addressed the root of the decline of Orchard Road — consumers are not leaving their homes to shop.

So what can a pedestrian-only street with a wider range of brands, products and F&B offerings do to help draw shoppers to Orchard Road? Most brands of products are available online and in the suburban malls. Our efficient delivery network also brings a wide range of cuisines straight to our dining tables at home.

What should we do with the abundant retail floor space in Orchard Road?

Fix #1 — Fix Out Of The Box

Let us unshackle ourselves from the concept of Orchard Road as a shopping mall. We propose that Orchard Road be recreated with a new identity where shopping and F&B play supporting roles to personal services: namely healthcare and education.

As a top priority, all existing area classified as retail could be given flexibility for a change of use to healthcare. Given the rapid increase in healthcare demand from the ageing mass affluent population in Singapore and in Asia, several malls in the Orchard Planning Area have already increased their floor area for healthcare services: Pacific Plaza, Lucky Plaza, Paragon, Wheelock Place and Shaw Centre.

About 1.5 million sqft, or 20% of the total lettable area of Orchard Road retail space, could be pre-approved to accommodate a wide range of primary care such as specialist clinics, medical diagnostics, cosmetics, traditional medicines, etc. and allied-care such as therapy and counselling, post-surgery rehabilitation services, nutrition consultants, physiology, etc..

The CFE could have noted that Singapore is not the only country facing an ageing population and most developed nations have greying populations and the demand for healthcare services is sure to grow.

The last available figure from the Singapore Tourism Board indicated that medical tourists spent almost S$1 billion in 2014. Against the stiff competition for medical tourists from India, Malaysia and Thailand, the increasing vacant space in Orchard Road presents us with a great opportunity to build on Singapore’s reputation for quality and safety in medical services and transform Orchard Road into a one-stop destination for the full range of primary and allied healthcare services.

Fix #2 — Learn Out Of The Box

To attract a wider range of visitors to Orchard Road, we propose a second layer of services to be added — education.

There is global awakening in the need for lifelong learning and we propose that Orchard Road be positioned to offer a full range of education services.

We envision another 20% of Orchard Road’s 7.5 million sqft of retail space be filled with education services such as enrichment and music classes, tuition centres for students undertaking formal education, playschools for infants and children, skills training centres for working adults, private education centres with formal certificate programmes, experiential learning providers, multi-modal online-offline symposium facilities, etc..

In fact, formal programmes involving retail, tourism, services and hospitality studies should cluster within Orchard Road as the learning experience is richer when learners are immersed in industry.

Services such as speech and language therapy and occupational therapy straddle both the medical and education fields and their co-existence could establish Orchard Road as a centre for innovation in therapy practices and skills training and education methodologies.

The initial costs of recreating Orchard Road to incorporate more healthcare and education services would probably fall somewhere between pedestrianising the entire road, and simply increasing the range of F&B offerings. However, the increased allocation of space for healthcare and education, while driving up competition, should bring about improvements in the quality of service and potential cost reductions.

The remaining 60% of Orchard Road’s nett lettable area will continue to house retail shops, F&B outlets and other services such as hairdressers and tailors. These traditional services will complement and support the healthcare hub taking the primary role, and the education hub, playing the secondary role in Orchard Road.

You might also want to read:

Is Orchard Road Too Pedestrian?

Should Orchard Road Traffic Be Stopped?

Bitter Medicine

The retail paradise of today is in cyberspace. Brick-and-mortar retail space on its own is fast becoming irrelevant in today’s world and hence, malls that primarily focus on attracting shoppers will go the way of the typewriter and the abacus. The convenience of e-commerce gives consumers fewer reasons to visit physical stores.

It is time that we shift our focus away from making Orchard Road a shopping centre. It needs to establish a new identity. Its retail space needs therapy. The medicine is in healthcare and education.

Ku Swee Yong is the CEO of International Property Advisor. His fourth book Weathering a Property Downturn is available in all good bookstores near you.

Main Image: PtrT / Shutterstock.com

The problem with Orchard has been systematic, and not a 1 or 2 solution to a problem.

Over the years, Singapore’s heartland malls have not only opened many more, but at the same time they have been upgraded so much so that most Singaporeans who stay in the suburbs don’t need to make a trip to Orchard Road any longer to do their shopping, unless it’s for something specific which is not available in some of the Mega Heartland Malls. And with internet shopping, this makes it even less of a reason to go Orchard for shopping.

ERP doesn’t help either, penalising the Locals who drive and consider going to Orchard Road to spend the weekend.

And now we even have tours to take tourists around the suburbs to enjoy heartland food centers.

With all the emphasis outside of Orchard Road, including retailers chasing after locals moving more to heartland malls, the ‘sparkle’ of Orchard Road is no longer a special one.

The fact is that we have too many malls, and still building more. It is not sustainable, however, market forces will come into play and ensure that there will be a hard reset but not until we have had a few very bad bruises from stock investors, and unfortunately for retailers as well, and finally consumers also get hurt due to rising prices and poorer and poorer quality as retailers find it more difficult to try new things and explore.

A revamp of Orchard Road, depending on who are your target consumers ?

I think a revamp of Singapore as a whole, rather than just Orchard Road, is the more important question.

Despite the official figures of increase of incoming visitors to Singapore, that increase is not being felt by retailers !!!

Why ?

Because Singapore is NO LONGER a ‘shopping haven’ ! Even Zara clothes sell for less in Taiwan than in Singapore, and the range is not less than Singapore and Taiwan also has a 5% sales tax. Singaporeans, at least for me and those whom I know, go overseas to do their shopping.

So i think the question starts with how to solve the Singapore retail ills, with deep pocket REITs controlling the rents … the root of the problem lies deeper that what’s available at Orchard Road.

Thank you for your analysis Damian. I have previously written articles about Singapore retail and this one specifically addresses the recommendations that resulted from CFE’s comments. If we looked deeper, REITs properties are doing better with more foot traffic, more activities, better tenant mix, cleaner and more welcoming environments. If they are doing better and their tenants enjoy better business, there is nothing wrong charging the rentals they charge. If a tenant cannot survive, there are many other tenants waiting to get into those malls.

Please look out for all these articles in my next book Preparing for the Property Upturn, to be published by Marshall Cavendish in September2017.

I think a third pill is landlords mindset must change. Ensure their tenants become more prosperous and profitable. Most businesses are suffering because rental is too high.