FOLLOWING the announcement of Charger Award winners at Thursday’s event, STORM.SG gets some comments from some of the award recipients.

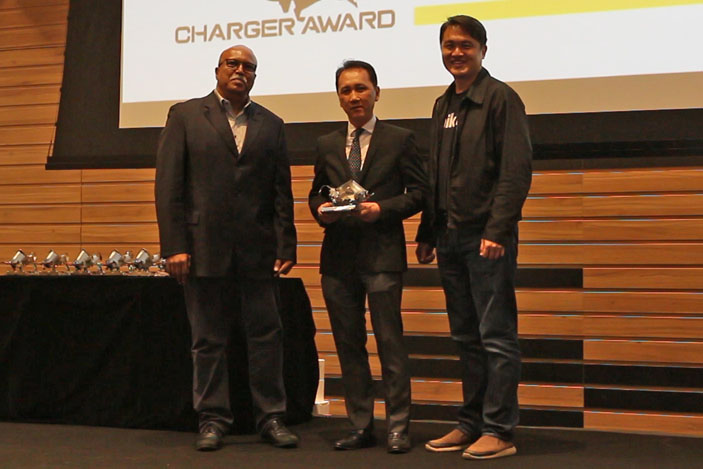

Above photo: Khoo Boo Hor, CEO of Sunningdale Tech, Kannan Chandran, Publisher of STORM.SG organiser of the Charger Award, and Tan Eng Beng, EVP OUE.

Khoo Boo Hor, Chief Executive Officer of Sunningdale Tech Ltd

We thoroughly enjoyed the insightful unique insights and perspectives from the panellists during the discussion sessions. This new initiative by STORM.SG with data from Spiking can only benefit the investment community by providing investors with the tools they need to uncover hidden gems in the market.

We are delighted to receive the inaugural Turbo Charger award in recognition of our efforts in innovation and creativity. Sunningdale was built on a culture of innovation. For us, receiving this award validates the hard work we have put in and provides us the impetus to chart new milestones in the year ahead.

Through intensive business development initiatives, we have maintained a stable order across our business segments. With our global manufacturing footprint, diverse customer base and wide product mix offering, we remain cautiously optimistic for FY2017. Overall, our long-term strategy of developing a sustainable and profitable business model remains on track.

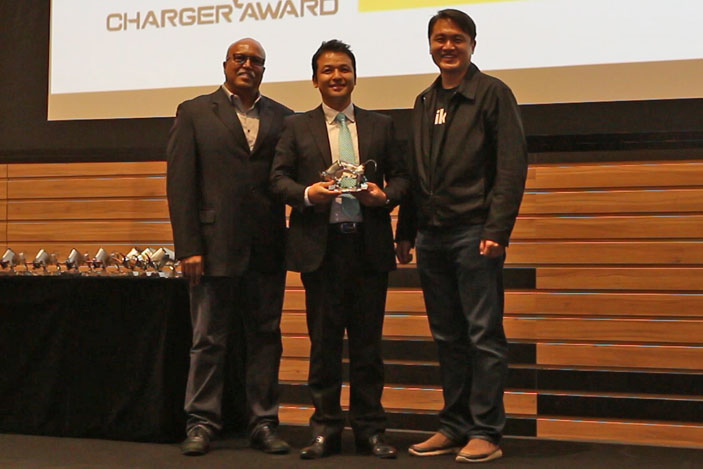

Tung Kum Hon, Chief Executive Officer, Geo Energy

We are pleased that investors have recognised our turnaround from years of losses to generate a record quarterly net profit in 4Q2016, the highest since listing. As a result, our share price has recovered from a low of 9.5 Singapore cents in calendar year 2016, to touch a high of 35.0 Singapore cents as of 28 March 2017. This has generated a one-year return of over 200%, an increase of more than US$100million in shareholder value.

Moving forward, we are in the process of completing the acquisition of PT Tanah Bumbu Resources, a coal concession that is adjacent to our current operating coal mine in South Kalimantan. This is expected to contribute significant cost synergies through more efficient mining processes, and will bring the Group’s mineable coal reserves to over 90million tonnes.

The completion of this acquisition is in line with our Group’s core business strategy of expanding our production and increasing our coal reserves. Our vision is to become one of Indonesia’s top-10 coal producers, and we have set a production target of 10million tonnes of coal in 2017, an increase of over 40% from the 5.5million we delivered in 2016, which reflects this.

We are also heartened by the strong support of the noteholders of our US$100million Medium Term Notes due January 2018, as expressed in the recently completed Consent Solicitation Exercise. We look forward to sharing more exciting developments with investors as details become available.

Tetsuo Ito, Chief Financial Officer, Croesus Retail Asset Management

We are encouraged that Croesus Retail Trust’s (CRT) has been recognised by the investment community as one of the highly preferred stocks in Singapore. We believe this is a strong testament of our efforts to raise CRT’s profile among investors through its achievements and positive performance since it’s listing. This recognition will further motivate us to continue to work on enhancing CRT’s portfolio and improve distributions for our unit holders.

CRT’s key objective is to deliver competitive returns to our unit holders through stable growth in distribution and capital value of our portfolio of assets. It has recorded good growth over the past financial year with our DPU (distribution per unit) rising year-on-year over the past few consecutive quarters.

We look forward to continuing our plans in making further headway in our asset enhancement initiatives and tenant replacement exercise, so we can increase our net-lettable area and attract high-quality tenants with potentially better performance. In doing so, we hope to maintain the growth momentum for CRT and achieve sustainable growth for our unit holders.

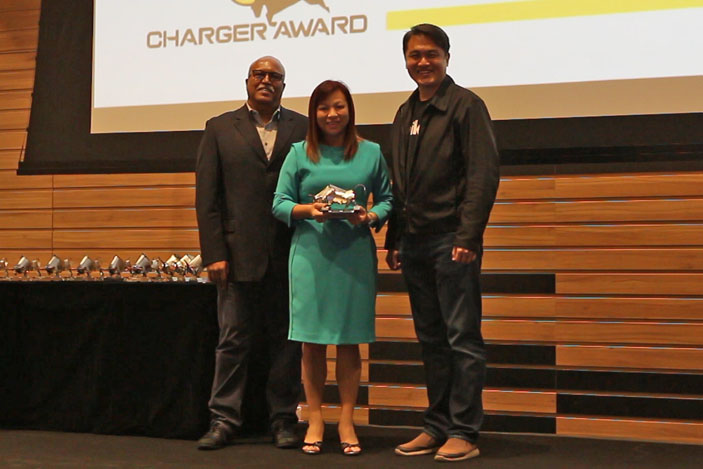

Ong Lay Koon, Executive Director, Lian Beng Group

It is an honour for Lian Beng Group to be spotted by big investors among so many other SGX-listed companies. These big investors clearly have discerned the investment merits of Lian Beng and understand the value in us.

Looking ahead, we are comfortable with our business growth strategy. We foresaw the weakening local private construction demand and started building up our recurring income business segments such as workers’ dormitory, property investment, etc. Our recurring income has grown and has mitigated the cyclical nature of our core construction business. We have also put greater focus on overseas property development and investment projects, especially in China, Australia, and UK. We should see the fruits of our overseas ventures in the foreseeable future.

You Might Also Like To Read:

The Charger Awards – Tips And Views

The inaugural Charger Awards commended 30 listed companies from the SGX that have excited investors in the past six months. See the full list HERE.

Do like us on facebook.