THE RECENTLY released Land Transport Master Plan 2040 gives a sense of government priorities and focus in terms of improving the land transport system in Singapore.

With zero car growth already implemented. Only recycling of Certificates of Entitlement (COEs) is allowed. Private car ownership is not encouraged, and, furthermore, with car-sharing schemes becoming more popular the competition for limited COEs will heat up thus reducing private car ownership, which will put private car sales under pressure.

However, there may be some relief from car leasing/rental schemes.The recent announcement of a new business model from CARROS may also have a positive impact on the secondhand car market.

Car growth will be seen from a segment perspective.

The pie is not getting bigger, but the percentage share between public and private vehicles, and also the percentage share of type and size of vehicles, will change.

Therefore, making the right bet on which type of vehicle best suits the segments (public, private) will either prove a boon or bane for car companies.

Who Needs Cars?

The percentage split between Internal Combustion Engines (ICE), Hybrids and Electric Vehicles (EVs) — Battery Electric Vehicles (BEV) and Plug-In Hybrid Electric Vehicles (PHEV) — is going to depend on the proliferation of charging infrastructure and/or new business models that would favour a steering wheel versus riding the bus or the MRT (Mass Rapid Transit).

The increased expenditure on last mile connections — covered walkways and personal mobility devices (PMDs) — on-demand buses, proximity to MRT lines, and cross-island highways and bus services will make it so convenient that it will thwart the desire for cars with high ownership cost.

Purchase will be a function of affordability, emotional needs of ownership (own or lease), or functional needs e.g., sales or helping the incapacitated.

Assuming we do increase the technology share of EVs, then infrastructure will be important.

When it comes to the government, the challenge is why subsidise car ownership which is the playground of the more well to do? Hence, the focus is on the public transport system.

Having said that, the EV Phase 2 co-funded by the government with BlueSG, car sharing has a cross cutting demographic impact in promoting car usage (the main reason for ownership), the revised Vehicle Emission Schemes, tries to equalise the cost of an ICE and EV by computing the negative and positive impacts of the respective technology on the air quality.

Furthermore, the BCA (Building and Construction Authority) Green Mark provisions points for having EV lots, and independent players like Greenlots (now owned by Shell), SP Group, Red Dot Power all have announced charging infrastructure deployment.

Based on the declared numbers, we will have more than 3,000 charging points installed which could support anything from 6,000 to 40,000 EVs if they are well distributed and accessible.

Today we have around 550 EVs on the road. There are already different business models in place from the EV charging infrastructure providers. The government also set up EV charging infrastructure standards in 2010, which were revised in 2016. The HDB now envisages the need for future ready infrastructure and are planning new estates with EV charging.

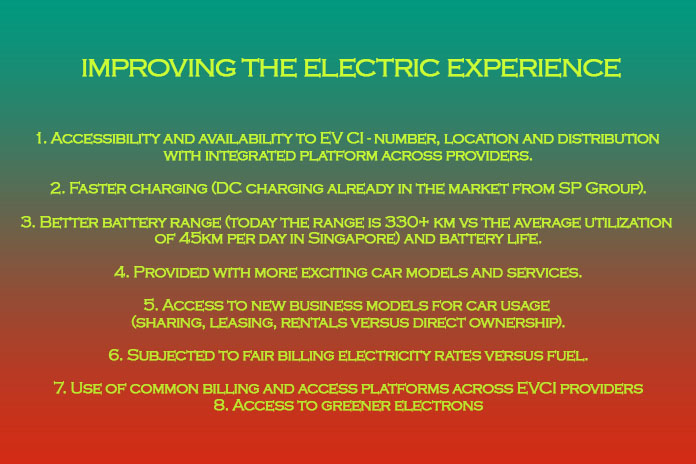

Charging infrastructure technology, standards, battery technology and car design will continue to improve. If we continue to improve the following, the impetus to switch will be market driven.

Understanding consumer needs and buying trends juxtaposed to the LTMP2040 and what it provides to the consumer is going to be key in making the right bets.

Dr Sanjay Kuttan is Chairman of the Sustainable Infrastructure Committee, Sustainable Energy Association of Singapore (SEAS)

Focus — Roll In The Changes: Views from the automotive industry.

Mobility Megatrends — Threats And Gains

Sharing In The Sharing Economy

Infrastructure Is Key In Going Electric