As the vultures circle for cheap pickings, Robinsons Department Store goes through its death throes.

You can’t blame COVID-19 entirely for the eventual fate of the department store chain after 162 years of business.

Back in 2014 we were already talking about how the department store model was under threat by technology (Read the article Malls Mauled In The Next Big Thing). Online shopping, high rentals and changing shopping patterns were putting the business model on shaky ground.

COVID-19 was probably the final nail in the coffin, as it forbade people from entering the physical space, but more tellingly, shoved them into the digital space, where online shopping beckoned with cheaper goods and easy, effortless pickings delivered to your doorstep.

ALSO READ: 2 Pills To Solve The Orchard Road Ills

A veteran of the regional retail scene expressed surprise at the plight of Robinsons. He said the closure was quite unexpected. He reckons Takashimaya and Tangs will prevail, but is uncertain about the future of Isetan and Metro in Singapore.

He added that the hiring of foreign CEOs at Robinsons meant that there was no appreciation of the local market’s requirement or the company’s legacy.

Adding to this, the Heeren location for Robinsons was “not right”. Perhaps a John Littles or Marks & Spencer would have worked better there, and at JEM (the Robinsons store closed at the end of August 2020).

Hard Numbers To Deal With

He added: “I reckon Robinsons’ gross margins will be between 25-28% of sales. The rent would be anywhere between 15-20% of sales in normal times.

“With COVID-19, rental would have exceeded 30%, leaving very little room for salaries and other operating costs.”

A real estate company owner, who didn’t wish to be named, reckons rental at a conservative $10 psf for upper floors and $100 psf for ground floor level could see Robinsons’ monthly rental bill in the region of $2.5 million.

ALSO READ: 3 Pills For Singapore’s Retail Ills

Should Singapore brands have more protection before being put up for sale? Or do we leave it entirely to market forces to determine the fate of companies that have enjoyed a long history?

Singapore Airlines seems to be well protected. It may hire more people, but both companies serve as the country’s tourism flag bearers to some extent.

A foreign owner will find it hard not to treat the business as anything but a business. That sense of belonging or heritage is not likely to flow through, even if it is spoken about.

Robinsons has changed hands a few times, and current owners, Dubai-based Al-Futtaim Group, which also own the Marks & Spencer and Zara brands, took over in 2008.

Robinsons employs 175 staff, many of whom will be joining the 170,000 jobs lost in the fist 3 quarters of 2020.

CapitaLand, will now have to hunt for a new anchor tenant a Raffles City, where Robinsons has occupied 3 floors since 2001.

Robinsons’ flagship store at The Heeren sits on six floors, occupying 186,000 sqft, which will pose a headache for the landlord given its location in a challenged district. Maybe Apple may want to spread its footprint along Orchard Road?

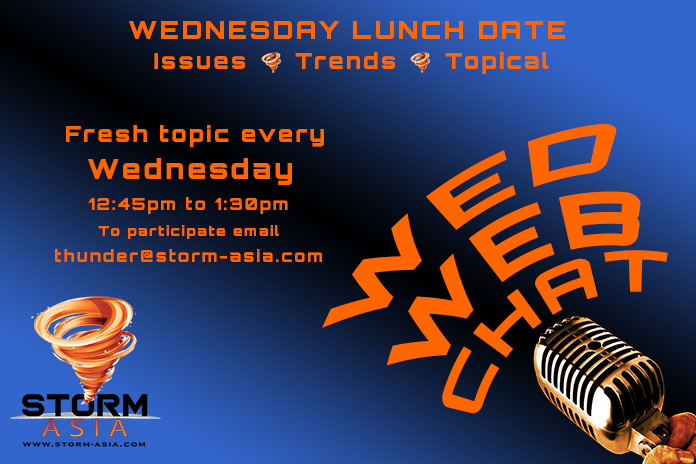

If you have a topic that is of interest, or have someone who would make a good panellist with a thought-provoking perspective on a subject, please email editor@storm-asia.com with your details and a short summary.