FINDING new opportunities in these turbulent times prompted a rousing discussion from the commentators at the inaugural Charger Award organised by STORM.SG.

We pick out the highlights from part one of the discussions that looked at surviving in the shrinking economy and the continued viability of REITs in Singapore.

The Millennial Syndrome

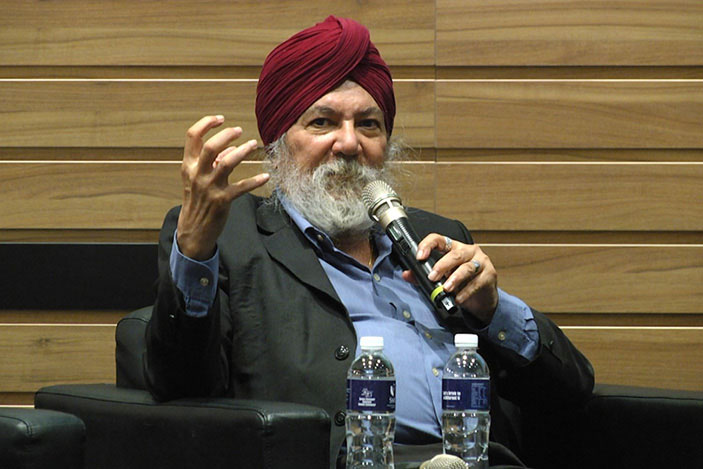

With the world getting evermore competitive, Kirpal Singh, Director, Wee Kim Wee Centre, Singapore Management University, suggests that it might not all be strawberry fields for the strawberry generation.

“There are dramatic shocks coming our way”, Singh forewarns, and millenials need to be ready for them. While they may be increasingly mobile and intrinsically part of the consumptive phenomenon, they are yet not bold enough to really venture out of their comfort zones in search of opportunities.

“We need a tenacious millennial, ready to push the limits — that’s the gung ho spirit we need. Lee Kuan Yew used to talk about a new generation with gumption, but that is missing today. Millennials need to be more persistent, resilient, and have a calculative cunning to seize the opportunities out there.”

Capitalising on Resilience

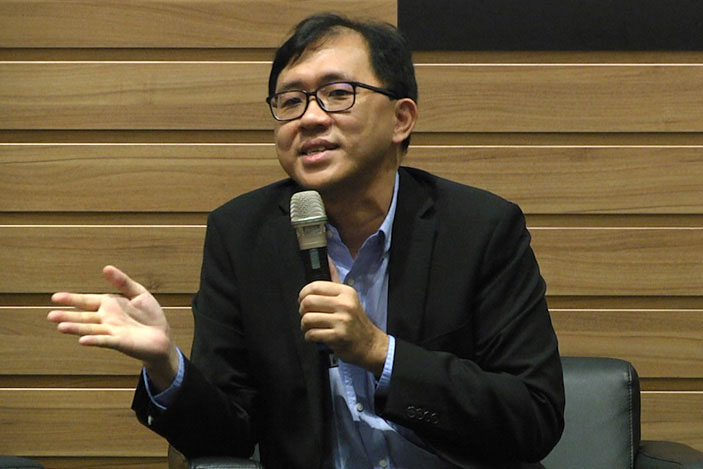

Clemen Chiang, CEO, Spiking, says that opportunities will present themselves amid the political and economic flux in the UK. The London stock exchange is facing Brexit and, more recently, a hung parliament, but they are extremely hungry to tell the world they are resilient. They want to show us that they still play an important role in the world’s economy and retain unparalleled access to capital in the international markets to convince more companies to list there.

And similarly, the SGX has ramped up its own efforts to attract more local companies to join the Catalist Board.

While changes are inevitable, there is still desire from both ends — people continue to search for good investments and companies are still looking for opportunities across different markets.

The Death of Retail?

Retail is at a cross roads according to Ku Swee Yong, CEO, International Property Advisor.

The industry is not doing well and is in need of immediate rejuvenation, as pointed out by the Committee for Future Economy. But Ku isn’t convinced they are on the right track.

He warns that introducing more retail choices into a flagging market will only lead to more ‘deaths’. Repositioning efforts undertaken buy some malls, particularly by increasing F&B offerings, does not impress Ku either. “Maybe there will be a spike of activity during lunch and dinner hours, but increasing F&B to more than 50% of floor area will just turn it into a semi ‘ghost town’,” he explains.

While retail REITs retain their popularity among investors, Ku advises caution and due diligence moving forward.

Check out the full highlights in the video.

Discussions at The Charger Award features opinions and views from: Independent Director and Investor Chong Huai Seng; Clemen Chiang Ph.D, CEO Spiking; Kamal Samuel, Managing Director, Financial PR; Prof. Kirpal Singh, Director, Wee Kim Wee Centre, Singapore Management University; and CEO of International Property Advisor Ku Swee Yong.

NOTE: This is not a recommendation to buy or sell shares in the companies. You are advised to do your own due diligence.

You Might Also Like To Read:

Charger Award — 7 Things We Learnt

Charger Award — Winners’ Views

The inaugural Charger Awards commended 30 listed companies from the SGX that have excited investors in the past six months. See the full list HERE.

Do like us on facebook.

[thb_gap height=”50″]