Most crypto news goes through Crypto Twitter (CT), updates are in real time. Much like a blockchain this logging of events quietly unfolds in the background, somewhat detached from current affairs. When CT events are featured in the headlines of major news outlets, it tends to be because of historic price pumps or catastrophic failures. This happened to be the latter.

The Players — FTX & SBF

Sam Bankman-Fried or SBF (pictured above) is at the centre of this story. The 30-year-old MIT physics graduate spent the first 3.5 years of his career working as a trader for Jane Street, one of the world’s largest market makers. He founded his own crypto focused trading company, Alameda Research, in late 2017 with his friend Gary Wang.

Their overnight success was owed to their Bitcoin (BTC) arbitrage trades between the US and Japan; at the time BTC was 10% cheaper in the US. This trade, which they started with just $200, became known as the Kimchi Premium, and quickly scaled up to $10 -– 50 million dollars of cross border BTC trades per day.

Rising to prominence in the industry, Alameda traded almost every coin on almost every exchange. They boasted 4 – 5% profits in a bear market, eventually amassing enough coins and tokens to become one of the largest market makers in crypto. Eventually they ended up working with almost every crypto exchange, and starting their own futures focused exchange, FTX.

The biggest crypto exchange, Binance, led by CEO Changpeng Zhao (CZ), was one of their first investors. FTX was founded in April 2019 with Sam as CEO, Gary as CTO and Binance as one of its biggest backers. Both FTX and Binance are registered in the Bahamas. Although technically stepping down as Alameda CEO, the connection between FTX, Alameda and SBF remained ambiguous. The CEO of Alameda Research during the collapse was Caroline Ellis, who took the job in 2021.

In the summer of 2019 the private sale of the FTT token jumpstarted FTX, where 20% of its initial supply of 350 million was sold to investors including Alameda, Binance, Coinbase, Multicoin Capital and other crypto VCs.

Since the collapse, only Multicoin has been burned. Its primary uses were as collateral for futures trading and to lower trading fees on the FTX platform.

The Collapse

On the 2 November, Coindesk published an article revealing that as of 30 June, more than 1/3rd of their $14 billion balance sheet was held in FTT.

Several days later, CZ announced Binance would be selling its FTT supply. In 2021 FTX had purchased back Binance’s shares in the company for roughly $1.5 billion in the BUSD stablecoin and $580 million in FTT. The fallout originated from the leaking of information on Binance to FTX by former Binance US CEO, Brian Brooks. FTX had also been lobbying regulators against Binance and was also suspected to be involved in many media hit pieces published on Binance.

Speculation stirred around the relationship between FTX and Alameda. Despite being the second biggest centralised crypto exchange by trading volume, similar events involving Celsius and other exchanges that had misused customer funds have left the community scarred and ready to protect capital. Rumours began circulating that user funds from FTX were being traded by Alameda behind the scenes; many began to worry that FTX was insolvent and unable to return user funds. This led to some users testing to see if they were in fact still able to withdraw from the platform and some took the precaution of withdrawing altogether.

The withdrawals accelerated when chain analysts realised that FTXs reserves of BTC, ETH, stablecoins and other reserves were rapidly decreasing. Alameda was simultaneously withdrawing these assets and sending them to FTX, further dissolving confidence in FTX’s solvency and hastening the rate of withdrawals.

After announcing they would be selling this huge amount of FTT, both FTT and Binance’s BNB coin plummeted as speculators feared both holding FTT and retaliation from FTX, either dumping or delisting the BNB token.

Alameda’s Caroline then publicly offered to buy the entire Binance FTT supply at $22 a piece over the counter. This led to fears that the FTT token itself was being used by FTX and Alameda as collateral for crypto loans and the offer was due to fears of liquidation. While not currently provable, there is some evidence that FTT was being used as collateral for much of the Futures trading on FTX.

While having a large fully diluted market cap, the FTT token had very low liquidity and hence very little buying or selling was required to significantly increase or decrease its price. It is likely that the ensuing collapse in FTT price was driven entirely by fear, before Binance had the chance to sell much of their FTT supply. The rapid drop in FTT price likely liquidated many of the FTT backed trades occurring on FTX, while the company dumped other tokens to prop up the FTT price, resulting in the collapse of other token prices.

This kind of bank run should not happen in crypto; centralised platforms are not supposed to be “fractionally reserved.” But just like a bank, FTX ended up pausing withdrawals as they were unable to return the majority of customer funds.

To confirm the chaos was real, CZ then publicly offered to buy FTX, temporarily putting the selling cascade on hold. However, Binance later pulled out of the deal after FTX revealed an $8 billion deficit. The Alameda website has since gone offline.

In the wake of this mayhem, other exchanges came under fire. Eventually the majority of them published some kind of “proof-of-reserves”, except for the centralised exchange BlockFi who paused withdrawals.

The Situation Is Still Unfolding

SBF could be seen playing League of Legends after the chaos of the day had unfolded. In the following days he began tweeting single letter messages for several days leading to suspicions he was tweeting under duress; a few days later he delivered a rambling apology and closing with a passing shot at CZ, “well played, you won”. He has since done a poor job convincing people that he saw the experience as anything more than a game.

Currently lending platform Genesis seems to be the next domino in line to fall. They provided the yield for “earn” programs on many centralised exchanges such as Gemini. Genesis’ backers GCB could follow if their balance sheet has been shaken badly enough.

The extent to which FTX and Alameda were intertwined with the rest of the market should not be understated, as one of the largest market makers in the industry they owned a substantial percentage of all crypto on every exchange.

The companies were also the largest recipient of all the USDT stablecoins that have been printed by Tether; of the $110 billion USDT minted between 2014 and 2021, Alameda received around $50 billion. Through their defi project Serum, they were also a huge source of defi liquidity, particularly for projects on the Solana blockchain. The price of Solana has consequently taken a big hit.

The list of companies FTX or Alameda were funding is staggering. Celebrity promoters who have also been burned have been sued for promoting the exchange, including Larry David, Tom Brady and his now ex-wife Giselle Buendchen, Shaquille O’Neal and Stephen Curry.

In the days following the collapse the Bahamian government took custody of the remaining FTX assets. It is unclear whether they are the “hacker”, either way on-chain it could be seen these funds were converted into Ethereum and then slowly being sold for Bitcoin, causing a drop in the price of the former.

Conspiracy Theories And Weirder News

The fact that SBF and his accomplices are still free to roam is conjuring up a storm of conspiracy theories about their connections. The most extreme are of course that this was an elaborate sting operation to capture or crush crypto and give regulators even more fodder to bring the industry to its knees. Just for comparison Bernie Madoff was arrested 24 hours after his investment scandal collapsed, he was however allowed to post $10 million in bail.

On CT, many used to joke that Crypto was really “Sam’s world,” and we were merely living in it. SBF was the god child, bailing out other insolvent CEXs and halting the cascade of liquidations that took place after the LUNA/UST crash. But it looks like his company may have been the cause of that crash, now potential candidates for the bulk selling of the decentralised stablecoin UST that triggered the depegging event, driving the value of LUNA from $100 to its current price of just over $0.0001.

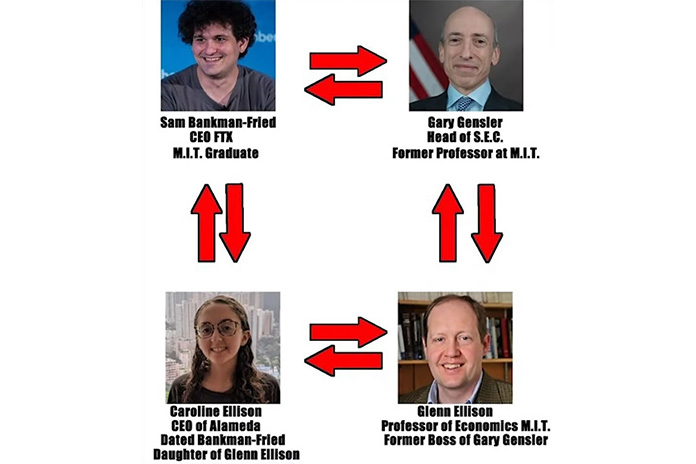

SBF was an MIT graduate, while Gary Gensler, the chairman of the SEC and main actor in crypto regulation was a former MIT Professor. Glenn Ellison, an MIT economics Professor and former boss of Gary Gensler is the father of Caroline Ellison. Sam and Caroline also used to date, if anyone cares. In fact, the FTX and Alameda crew formed a ‘polycule,’ while based in the Bahamas, a polyamorous group in which all were romantically linked. The nerd fantasies deepen.

SBF’s parents are both Professors at Stanford Law School and heavily left leaning democrats (with respect to American politics). Barbara Fried is a tax expert who also researches “questions of moral philosophy and distributive justice”. She led a left-wing super PAC that has funnelled millions of dollars to Democrats. Her work covers the idea that the philosophy of personal responsibility has ruined criminal justice and economic policy, suggesting we move beyond blaming criminals due to their lack of free will. So, it is unlikely that Sam will be chastised by his family.

For now, these are all just conspiracies, so for the sake of brevity we will leave the readers to do their own research.

Caroline spent much of 2021 posting about her regular amphetamine use on Twitter. From 5 April 2021: “Nothing like regular amphetamine use to make you appreciate how dumb a lot of normal, non-medicated human experience is.”

FTX And Singapore

FTX was a popular crypto exchange among Singaporeans. People have questioned whether the “banning” of Binance encouraged people to use FTX, the second biggest trading platform.

While neither Binance nor FTX had licence to operate in Singapore, Binance had been placed on the Investor Alert List (IAL) as it had been attempting to solicit to Singaporean investors prior to gaining approval, even going as far as to offer Singapore specific payment methods ala PayNow and PayLah. FTX did not attempt to solicit its services in Singapore and hence faced no such ban. Binance then proceeded to put in place measures such as geo-blocking of Singapore IP addresses and removing its app from Singapore app stores, to restore good faith. MAS states that “should Binance decide now to dismantle some of these restrictions, it has to continue to comply with the prohibition against soliciting to Singapore users without a license”.

Just like with regulations, criticising MAS for failing to protect retail crypto users solves nothing. Singapore authorities have had a relaxed attitude towards crypto entities and while there have been some failures and rogue entities, it has resulted in the development of vibrant crypto and NFT communities as well as the reputation as a haven for developers and entrepreneurs.

Singapore has had a friendly attitude towards cryptocurrency-related activities, but to quote Ethereum founder Vitalik Buterin, “the biggest risk of being friendly is if you end up attracting the terrible people”. Singapore wishes to protect its investors but realises overprotection runs the risk of stifling innovation.

The Bottom Line

Crypto did not fail in this instance. People and their apparent greed failed. All decentralised exchanges and chains continued to run as if nothing had happened.

While many platforms have begun publishing so-called “proof of reserves”, suspicion around the solvency of centralised exchanges still remains. There has been some suspicious activity around this proof, it seems that many exchanges may be making wallet transfers to appear solvent. While the blockchains do not lie, the exchanges seem to be unwilling to offer this same level of transparency.

Crypto needs to adopt standards; ideally these would be voluntary industry standards such as regular public updates of stablecoin and exchange reserves, enacted for the safety of retail customers before regulators are forced to impose more stringent requirements.

One of the most common sayings in the crypto community is, “not your keys, not your crypto”. It only took several major centralised exchange-related crises for people to take this seriously.