WHAT a mess Scoot airline leaves its passengers in.

From flight delays to turn backs because of unclaimed unaccompanied cabin baggage, and grounding them on the tarmac for hours, this is one airline you’d best be prepared for anything to happen. And if you think you’ve got insurance cover and are safe, think again.

Even with insurance purchased from the airline you get next to nothing back when your flight is cancelled the day before departure and you have to book an entirely new travel destination a few days later, complained one business class customer. All she was compensated for was the minimial incremental difference in ticket price.

Insurance companies and airlines work hand-in-glove.

While Scoot’s been copping it a fair bit since last year for its various delays and malfunctions, it’s far from alone in this dismal tale for the passenger.

With budget airlines taking to every conceivable nook and corner, everybody wants to get that $20 flight to somewhere. It does put a strain on loads and facilities during the holiday breaks, so expect delays from congestion and bad weather or a union go slow somewhere.

On the flip side, there’s money to be made.

Article Follows…

Travel insurance has always been offered as an option to passengers when booking their flights. Some see it as an unnecessary extra whereas some diligently purchase a policy prior to setting off. In view of recent events, flyers want to be covered more than ever should they fall victim to delays, among other unwelcome occurences.

The Top Inconveniences

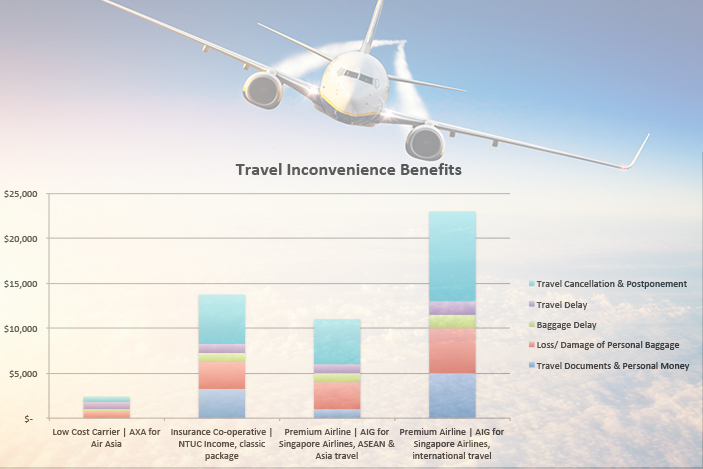

Policies vary based on various factors: Airline vs. independent provider; single trip vs. annual plan; short vs. long haul flights. For simplicity’s sake, below is a comparison of basic policies from three different providers (low cost carrier, insurance co-operative and premium airline) for the top travel inconveniences faced: flight delays and lost or damaged baggage and personal belongings.

Looking at the benefits for flight delays, most policies only provide for delays in blocks of 6 hours: $80 for every 6 hours of delay up to $800 with Air Asia1; $100 for every 6 hours of delay up to $1,000 with NTUC Income2; $100 for every 6 hours of delay up to $1,500 with Singapore Airlines3.

The powers that be have dictated that any delay less than 6 hours is not considered an inconvenience. Let’s see if they feel the same way when it affects them.

In less than 6 hours, phone batteries could go dead, client meetings could be missed and roaming charges could be incurred for that all-important phone call you’ve been waiting to take for days.

As for lost or damaged baggage and personal belongings…

With only $200 for any one item up to $800 with Air Asia1, we didn’t really expect much from a budget airline. NTUC Income is more detailed by stating $1,000 limit for one laptop, $200 limit for watches, jewellery or valuables in total and $500 limit per set of other items with all this adding up to a maximum of $3,0002. Lastly, Singapore Airlines insures up to $5,000 for personal baggage including laptop3.

Interesting how valuable items that ought to be insured can be excluded. For example, computers, cameras and money are excluded by Air Asia. Likewise, Singapore Airlines excludes jewellery and watches among other things.

Getting Your Money Back

Moving on to the submission of claims. While all three providers allow claims to be submitted online, therein lies the need for documents that may or may not be reasonably required. For example, when claiming for lost or damaged baggage and personal belongings, Air Asia requires proof or purchase of articles such as receipts or credit card statements.

Based on our analysis of travel inconvenience benefits provided by the three different providers, it comes as no surprise that benefits from the low cost carrier insurance are the lowest at $2,400 and benefits from the premium airline insurance are the highest at $23,000. Also, as expected, the low cost carrier insurance does not cover loss of travel documents and personal money at all.

Article Follows…

However, as observed in the chart, insurance provided by the premium airline does not necessarily provide the most coverage when it comes to regional travel. For travel within Asia and ASEAN, Singapore Airlines only provides $11,000 worth of coverage as compared to $13,750 by NTUC Income.

Travel insurance policies contain plenty of fine print, not to mention unspecified extraordinary circumstances that could prevent insurance agencies from paying out compensations as well. You would be prudent to go through them with a fine-toothed comb and ask your agent questions to determine whether or not you will benefit from travel insurance or if you even need it at all.

Sometimes, your credit card may already cover you if you used it to purchase your airline tickets.

If you’re a regular traveller, get an annual travel insurance package. It will be heaps cheaper in the long run. And you may want to get it from an agent you know who will chase down the money for you in the event of a claim.

In this current aviation climate, he or she will be kept busy.

Footnotes

Good avice from storm. Now i know what to do till another insurer comes along.