THE FLIP side to technology could have a significant effect in the property industry.

It is estimated that technology could result in the loss of anywhere from $15 million to $30 million worth of legal fees and over $100 million worth of agency commissions annually. Not to mention job losses in the thousands among property agents.

The Real Estate Industry Transformation Map (ITM) was announced by Dr Koh Poh Koon, then Minister of State for National Development at his ministry’s Committee of Supply debate in March 2017. In support of the ITM, HDB streamlined the resale transaction process and introduced a new HDB Resale Portal.

The powerful system allowed people to check on their eligibility to sell or buy a flat, halved the transaction process to 8 weeks, and reduced the number of appointments with HDB to just one. The bulk of transactions will not require a valuation report to be provided by a third-party valuation firm.

The Largest Property Trading Portal

With over one million HDB flats and over three million occupiers in total, the HDB Resale Portal will be one of the largest property trading portals in the world!

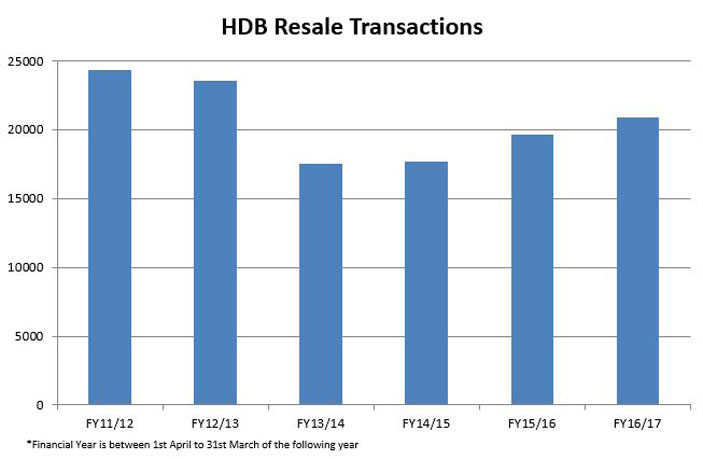

Every year, more than 20,000 resale transactions and over 30,000 rental transactions may be put through this system.

And if we added on new technologies such as e-contracts, blockchain and big data, we will have a property portal that can provide buyers, sellers, tenants and sub-tenants with fuss-free resale and rental transactions. Bank loans could also be integrated into the system via e-contracts, simplifying the process further.

This could all be a part of creating a “future-ready real estate sector that will continue to provide good jobs for Singaporeans” as announced by Dr Koh.

You Might Also Like To Read:

Low Population Growth And Low Property Values

The New Tech — New Jobs Disconnect

Jobs Will Be Lost

With such a powerful portal, we foresee four areas where businesses will be impacted by this efficient system.

1. No Valuation Report

As it stands, the new procedures have reduced the need for external valuation reports. We estimate that about 80% of the annual 20,000 resale transactions will not require an external valuation report. This saves time and cost for the resale participants. It also removes about 16,000 cases from the valuers’ desks. For the qualified valuers, our guess is that about 50 jobs may have to be reconfigured, i.e. they will have to work on other real estate segments such as private residences and industrial properties, or expand their capabilities to include tax valuation and consultancy.

2. No Lawyers Needed

Since HDB is the owner of the flats, “sellers” are merely transferring the long-term leases to the “buyers” through HDB’s website in “resale” transactions. About 90% of these transactions are normal transactions which do not involve court orders, such as in divorce or inheritance cases. We estimate that for 90% of resale transactions, lawyers would not be needed to represent the parties involved especially if bank loans were seamlessly integrated into the portal. Based on checks with lawyers, about 50 lawyers’ jobs could be reorganised with less conveyancing work for HDB transactions.

3. Greater Transparency

With the infrastructure in place for this portal, it is fairly easy for HDB to allow all “buyers” and “sellers” who have registered their intent to transact to see each other. The flats of all the qualified and eligible “sellers”, their flats’ selected photographs, location and asking prices could be displayed on the portal for all qualified and eligible “buyers” to view. The information displayed on this portal would have much better integrity than independent property portals as it would only contain listings of flats for sale after the “sellers” have been confirmed as eligible by HDB. When the HDB Resale Portal becomes a listing portal, we estimate that the number of HDB listings in newspapers and independent property portals will reduce by up to 90% from today.

4. DIY Transactions

“Buyers” and “sellers” will logically adopt the DIY service model that immediately eliminates the need for estate agents. Eligible “buyers” and “sellers”, both pre-qualified by HDB, meet online and exchange viewing schedules, then negotiate and settle on a price and click through to the final steps to obtain HDB’s approval for the resale transaction.

What will be the relevance of estate agents when the owner of this portal is also the approving authority and the owner of the flat? The portal would perform the role of an agent with greater transparency, efficiency and without listing costs and commissions! How many property agents could possibly lose their jobs?

There were 20,894 resale HDB transactions in Fiscal Year 2016-2017.

We estimate that as much as 80% (or 16,715) of the resale transactions will eventually be completed directly without any property agents involved. Only about 20% or 4,000 transactions annually would require property agents to serve either the “sellers” and/or the “buyers”.

The main reasons that these transactions require the services of property agents are family issues, language and education issues and insufficient time for self-service.

Currently, about 15,000 out of the 30,000 property agents are involved in HDB resale and HDB rentals.

When HDB Resale Portal allows “buyers” and “sellers” to see each other for DIY transactions, up to 10,000 agents’ jobs will be affected. Of these, 5,000 might leave the industry altogether. The other half will have to move to other segments such as industrial or commercial properties or expand into international property sales.

As the average total commission per transaction of a $400,000 resale HDB flat is around 2% for both “buyers” and “sellers”, the 16,715 cases taking the DIY route would reduce industry commissions by about $128 million per year.

Other Services Added

As Singapore presses ahead with automation of processes for greater efficiency, you could see municipal services, utilities and a whole array of e-commerce services being added onto the list, and private residential properties could be transacted through a sister portal.

Such technological disruptions and transformations will continue to gain traction, bringing lots of convenience to all the households in the Smart Nation.

Some property agents who are looking at the horizon, are already consolidating and looking for public funding through IPOs. Generally, property agents and conveyancing lawyers should brace themselves for the impact to come.

Ku Swee Yong is a licensed real estate agent and the CEO of International Property Advisor. Additional research by Justin Chong undergraduate, School of Design & Environment, National University of Singapore.